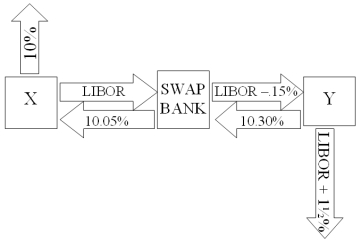

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Futures Price

Futures Price is the agreed-upon price for the purchase or sale of a particular asset at a future date, determined in the futures market.

Stock Index Futures

Futures contracts to buy or sell a specific stock index at a predetermined price on a specified future date, used for hedging or speculating on the direction of the stock market.

Multiplier

A concept in economics referring to the factor by which a change in investment, government spending, or other economic activity results in a larger change in the gross domestic product (GDP).

Dollars

A unit of currency used in the United States and other countries, symbolized as $.

Q20: Now suppose that Southern workers are paid

Q22: XYZ Corporation,a U.S.parent firm,has a wholly owned

Q30: The extent to which the value of

Q32: The adjusted present value (APV)model that is

Q34: The Asian crisis<br>A)followed a period of economic

Q36: Find the present value of a 2-year

Q39: Explain how firm B could use two

Q51: The LIBOR rate for euro<br>A)is EURIBOR.<br>B)is a

Q51: In the 1960s,Coca-Cola,which had bottling plants in

Q98: Underwriters for an international bond issue will