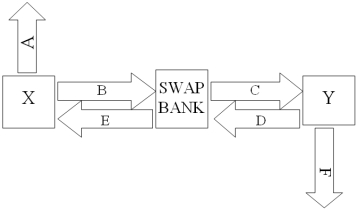

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume both X and Y agree to the swap bank's terms.

Fill in the values for A,B,C,D,E,& F on the diagram.

Definitions:

Bank Loan Payable

A financial obligation representing money borrowed from a bank that a company is required to pay back with interest by a specified future date.

Prepaid Insurance

An asset account on the balance sheet representing insurance payments made in advance for coverage that will extend over a future period.

T Account

A visual representation used in accounting to depict the debit and credit sides of an account, helping in the preparation of financial statements.

Credit Balance

A situation where the total credits in an account exceed the total debits, often indicating the amount owed to a creditor.

Q34: Find the debt-to-equity ratio for a firm

Q42: Using the notation of the text,the

Q44: Global bond issues<br>A)can save U.S.issuers 20 basis

Q45: Since fixed assets and inventory are usually

Q57: Using the APV method,what is the value

Q61: Calculate the euro-based return an Italian investor

Q88: The models that the credit rating firms

Q94: Forward rate agreements can be used for

Q98: Suppose the domestic U.S.beta of IBM

Q98: Your firm is in the 34% tax