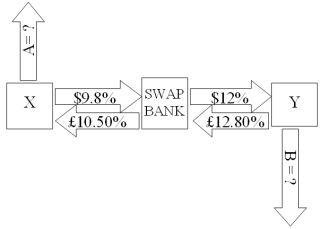

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are: A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap,what external actions should they engage in?

If company X takes on the swap,what external actions should they engage in?

Definitions:

Brand Awareness

The degree to which consumers recognize and are familiar with a particular brand, its products, or services.

Social Media Campaign

A coordinated marketing effort designed to reinforce or assist with a business goal using one or more social media platforms.

Brand Style

The distinct design, visual look, and feel of a brand's marketing and communication materials.

Content Strategy

How you go about sharing specific assets online depending on the audience, platform, and community related to your personal brand.

Q3: The required return on equity for an

Q4: The product life-cycle theory predicts that<br>A)over time

Q7: Synergistic gains<br>A)are obtained when the acquiring firm

Q10: A major that can be eliminated through

Q38: Recent studies suggest that agency costs of

Q71: Your banker quotes the euro-zone risk-free rate

Q72: Today is January 1,2009.The state of Iowa

Q72: When exchange rates change<br>A)the value of a

Q76: A bank may establish a multinational operation

Q101: You entered in to a 3*6 forward