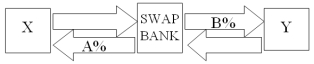

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year.The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00*(1.08) /£1.00*(1.06) = $2.0377/£1.Their external borrowing opportunities are: A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Strategic Thinking

The ability to anticipate, envision, maintain flexibility, and work with others to initiate changes that will benefit in the future.

Risk-taking Behaviour

Refers to the propensity of an individual or organization to engage in actions that have potential for significant loss or gain.

New Opportunities

Refers to emerging chances or prospects that can potentially lead to growth, development, or benefits in various contexts such as business, career, or innovation.

Internal Locus

A psychological concept indicating that individuals believe they have control over the events in their lives.

Q3: Which term correctly describes the following situation?

Q7: Suppose that you are a U.S.producer of

Q17: Compute the NPV at the current price

Q20: Honda's decision to build a plant in

Q27: Assume that XYZ Corporation is a

Q45: With regard to dual-currency bonds versus comparable

Q54: A stop order is an order to

Q64: The Toronto Stock exchange<br>A)is fully automated.<br>B)features electronic

Q73: Which of the following statements about transfer

Q101: Hedge fund advisors typically receive a management