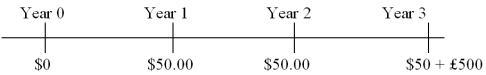

Find the value of a three-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Cost Reconciliation Report

A report that bridges the gap between the opening and closing balances of a job or project, detailing all the costs incurred.

Ending Work in Process Inventory

The total value of partially completed goods that are still undergoing production at the end of an accounting period.

Job-order Costing

An accounting method used to track the expenses of specific jobs and calculate the cost of production for each job.

Process Costing

Process costing is an accounting methodology used for homogeneous goods, which systematically allocates the costs of production for each unit by averaging the total costs over all units produced.

Q1: Exchange rate fluctuations contribute to the risk

Q2: An Offshore banking center is<br>A)a country whose

Q13: What is the relative price of a

Q27: A market-value index<br>A)is calculated such that the

Q52: A bank may establish a multinational operation

Q53: First impressions are often overrated and play

Q74: Which is growing at a faster rate,foreign

Q81: A multinational firm can be defined as

Q85: Suppose that trade occurs.Each country completely specializes

Q92: Under the investment dollar premium system,<br>A)U.K.residents received