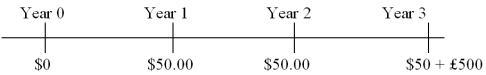

Find the value of a three-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Real Property

Land and anything permanently affixed to it, such as buildings and structures, legally recognized as immovable property.

Permanent Improvement

An addition or change to a piece of property that increases its value and is designed to last for a long period of time, such as building an extension.

Durable Power of Attorney

A legal document that grants one person the authority to act on behalf of another person in financial or health matters, remaining effective even if the grantor becomes incapacitated.

Incapacitated

Refers to a state in which an individual or entity is temporarily or permanently unable to perform their duties or activities due to physical or mental limitations.

Q3: Floating for floating currency swaps<br>A)the reference rates

Q13: Identify and describe the different types of

Q57: When a country is more remote,with an

Q58: Calculate the euro-based return an Italian investor

Q70: Also,MNCs often find it profitable to locate

Q71: The difference between accounting exposure and translation

Q72: Pricing a currency swap after inception involves<br>A)finding

Q82: Explain how firm A could use two

Q86: In the wholesale money market,denominations<br>A)are at least

Q89: Suppose that you are a swap