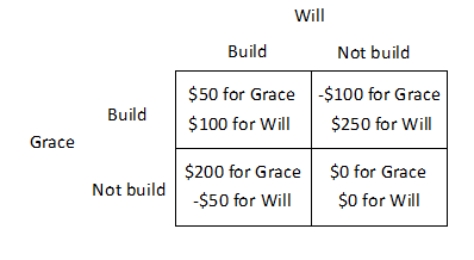

Will and Grace have adjoining unfenced back yards and each has just adopted a new puppy. Will values a fence between their yards at $250 and Grace values a fence between their yards at $200. The cost of building the fence is $300, which will be split equally if they both agree to build the fence. Therefore, their payoff matrix is as follows.  This game is a(n) ______ because ______.

This game is a(n) ______ because ______.

Definitions:

Consolidated Financial Statements

Combined financial statements of a parent company and its subsidiaries, showing the financial position and results of operations as a single entity.

Adjusting Entries

Journal entries made at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Business Combination Valuation Entries

Accounting entries made to reflect the fair market values of assets acquired and liabilities assumed in a business combination.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, recognizing the decrease in value of the asset over time.

Q1: Refer to the figure below. If this

Q23: If a one percent increase in the

Q30: When the price of a good is

Q39: You can spend $5 for lunch and

Q47: MegaCable and Acme are competing for an

Q64: In order to understand how the price

Q64: Refer to the table below. Pat's

Q90: The defining characteristic of an HMO is:<br>A)the

Q97: The United States generally has a comparative

Q101: The figure below shows Becky's daily production