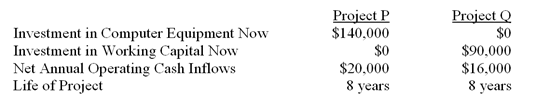

Alpine Company is analyzing two investment projects: P and Q. The following data are available:

The computer equipment for Project P will have a total salvage value of $8,000 at end of eight years. It will belong to Class 10 with a 30% maximum CCA rate. At the end of eight years, the working capital for Project Q will be released for use elsewhere. The income tax rate is 30% and Alpine's after-tax cost of capital is 10%.

-What is the approximate present value of the after-tax net annual operating cash inflows for Project P?

Definitions:

Internal Thoracic Vein

A vein that runs alongside the internal thoracic artery and drains blood from the chest wall and breasts into the brachiocephalic vein.

Ethical Dilemma

A situation in which a person must choose between options that are or seem to be equally unacceptable or dishonorable.

Conflicting Alternatives

Conflicting alternatives are options in a decision-making process that are incompatible with each other, presenting a challenge to reach a consensus.

Social Communication

The process of sharing information, ideas, and feelings with others in a societal context, using both verbal and non-verbal methods.

Q14: What is the maximum price per wheel

Q17: Given the following data: <span

Q22: Prevention costs and appraisal costs are incurred

Q24: The gross margin percentage is calculated taking

Q36: If the new product is added next

Q55: These muscle cells do NOT have a

Q59: The book value of old equipment is

Q68: Financial statements for Praeger Company appear

Q144: Martin Company reported an extraordinary after-tax loss

Q150: What was the after-tax net cash inflow