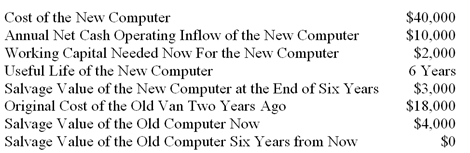

Eureka Company is considering replacing an old computer with a new computer. The following data relate to this investment decision:

The new computer will belong to Class 10 with a maximum CCA rate of 30%. The income tax rate is also 30%, and the company's after-tax cost of capital is 12%

-What is the approximate present value of the tax savings for all years because of the CCA tax shield?

Definitions:

Emmetropia

The condition of the eye where the optical system is perfectly matched to the length of the eyeball, resulting in sharp vision at all distances.

Visual Acuity

The clarity or sharpness of vision, often measured by the ability to discern letters or numbers at a standardized distance on an eye chart.

Conjunctivitis

An inflammation or infection of the outer membrane of the eyeball and the inner eyelid, also known as pink eye.

Chalazion

A benign, painless bump or nodule inside the upper or lower eyelid caused by inflammation of a meibomian gland.

Q1: Orange Company's current ratio at the end

Q14: What is the maximum price per wheel

Q71: The net present value of this investment

Q81: The Hyatt Company is trying to

Q116: Which of the following would be classified

Q136: What were Division A's sales?<br>A) $125,000.<br>B) $200,000.<br>C)

Q174: Crabtree Company's net income last year was

Q179: Lisa Inc.'s return on common shareholders' equity

Q184: Larosa Company's earnings per common share for

Q195: When the selling division in an internal