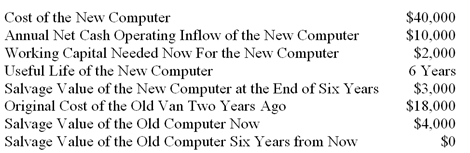

Eureka Company is considering replacing an old computer with a new computer. The following data relate to this investment decision:

The new computer will belong to Class 10 with a maximum CCA rate of 30%. The income tax rate is also 30%, and the company's after-tax cost of capital is 12%

-What is the approximate present value of the after-tax net annual cash operating inflows for all years?

Definitions:

FICA Tax

Taxes under the Federal Insurance Contributions Act, funding Social Security and Medicare, paid by both employees and employers.

Electronically

The process of sending or processing information using electronic systems or devices.

Form 4419

A form used by businesses to apply for authorization to transmit tax returns electronically to the IRS.

Intentional Disregard

Refers to the deliberate overlooking or violation of a rule or standard, particularly in legal contexts.

Q37: What will be the total external failure

Q51: Condensed financial statements of Miller Company at

Q53: Which of the following is NOT one

Q65: Which of the following is NOT a

Q66: Assume that Tolar decides to upgrade the

Q93: (Appendix 12A)Kircher,Inc.manufactures a product with the

Q119: A labour efficiency variance resulting from the

Q137: Narlock Company's times interest earned for Year

Q164: March Company's working capital (in thousands of

Q183: The inventory turnover ratio is equal to