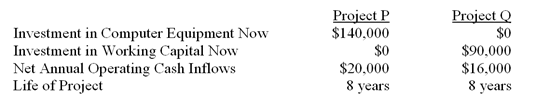

Alpine Company is analyzing two investment projects: P and Q. The following data are available:

The computer equipment for Project P will have a total salvage value of $8,000 at end of eight years. It will belong to Class 10 with a 30% maximum CCA rate. At the end of eight years, the working capital for Project Q will be released for use elsewhere. The income tax rate is 30% and Alpine's after-tax cost of capital is 10%.

-What is the approximate present value of the after-tax net annual operating cash inflows for Project P?

Definitions:

Polynucleotide Chain

A biopolymer composed of 13 or more nucleotide monomers covalently bonded in a sequence, forming part of the structure of DNA and RNA.

Nucleotide Excision Repair

A DNA repair mechanism that removes and correctly replaces a damaged DNA segment in the genome.

Nuclease

An enzyme that cleaves the chains of nucleotides in nucleic acids into smaller units.

DNA Ligase

An enzyme essential for DNA replication and repair, responsible for joining the breaks in the double-stranded DNA molecule.

Q4: What was the variable overhead spending variance?<br>A)

Q19: Ketosis<br>A)occurs when stored fats are rapidly degraded

Q61: One exocrine function of the skin is

Q73: The secondary structure of proteins is/are<br>A)the linear

Q83: During the year just ended,James Company purchased

Q85: Residual income is the operating income that

Q127: To put the working capital figure into

Q135: Financial statements for Rarity Company appear below:

Q137: Arthur operates a part-time auto repair service.He

Q200: The salary paid to a store manager