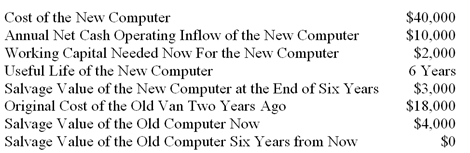

Eureka Company is considering replacing an old computer with a new computer. The following data relate to this investment decision:

The new computer will belong to Class 10 with a maximum CCA rate of 30%. The income tax rate is also 30%, and the company's after-tax cost of capital is 12%

-What is the approximate present value of the after-tax net annual cash operating inflows for all years?

Definitions:

Debt Financing

The method of raising capital through the sale of bonds, bills, or notes to individuals or institutional investors which must be repaid at a future date.

Choosing a Lender

The process of evaluating and selecting a financial institution or other entity that offers loans, considering factors like interest rates, terms, and conditions.

Investor

An individual or organization that commits capital with the expectation of receiving financial returns.

Guaranteed Loan

A loan backed by a third party, reducing the risk for lenders and often making it easier for borrowers to secure financing.

Q11: A company anticipates a taxable cash receipt

Q11: (Appendix 12A)The following information is available

Q18: The Jason Company is considering the purchase

Q86: Patridge Company uses a standard cost

Q95: The following standard costs pertain to

Q111: To determine the effect of income taxes

Q140: How is horizontal analysis of financial statements

Q162: Financial leverage is negative in which of

Q166: Financial data for Beaker Company for

Q199: Last year,Jackson Company had a net income