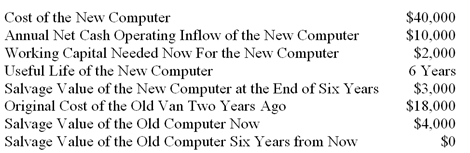

Eureka Company is considering replacing an old computer with a new computer. The following data relate to this investment decision:

The new computer will belong to Class 10 with a maximum CCA rate of 30%. The income tax rate is also 30%, and the company's after-tax cost of capital is 12%

-What is the approximate present value of the after-tax non-operating cash inflows that will occur in Year 6?

Definitions:

Self-monitoring

The practice of observing and recording one's own behavior, thoughts, or emotions, often for the purpose of self-improvement or therapy.

Response Discrimination

The ability to differentiate between various stimuli and respond accordingly, often discussed in the context of learning and behavior modification.

Data Analysis

The process of examining, cleaning, transforming, and modeling data with the goal of discovering useful information, informing conclusions, and supporting decision-making.

Self-management Approach

A strategy that involves individuals taking initiative and responsibility for their actions and well-being, focusing on setting and achieving personal goals.

Q29: The human genome refers to<br>A)all living human

Q47: (Appendix 10A)For raw material B,what were the

Q63: Madison Optometry is considering the purchase

Q113: Which of the following items is NOT

Q113: What was the fixed overhead budget variance

Q125: Orantes Company's average sale period (turnover in

Q147: (Appendix 11A)If two products are good substitutes,the

Q156: AB Company is considering the purchase of

Q175: What will be the total appraisal cost

Q192: What was the turnover for the past