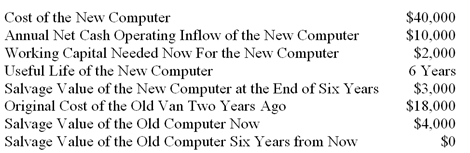

Eureka Company is considering replacing an old computer with a new computer. The following data relate to this investment decision:

The new computer will belong to Class 10 with a maximum CCA rate of 30%. The income tax rate is also 30%, and the company's after-tax cost of capital is 12%

-What is the approximate effective cost now of the working capital component of the investment decision?

Definitions:

Borrowing Capacity

Borrowing capacity is the maximum amount of credit that a person or organization can obtain, determined by lenders based on the borrower’s financial health and credit history.

Outside Funds

Capital sourced from external investors or institutions, outside of the company’s existing financial resources, used for expansion, operations, or investment.

Debt

Money that is owed or due to be paid to someone else, often resulting from loans or credit.

Equity

Equity represents the value of an owner's interest in a property or business, after deducting liabilities.

Q27: Which of the following is NOT true

Q43: The following standards for variable manufacturing

Q48: (Appendix 12A)What is the markup percentage needed

Q55: Lusk Company produces and sells 15,000 units

Q90: Redner,Inc.produces three products.Data concerning the selling

Q104: Process time is the only value-added component

Q113: (Appendix 12A)The markup on absorption cost for

Q118: What was the materials price variance?<br>A) $420

Q121: How many minutes of milling machine time

Q140: How is horizontal analysis of financial statements