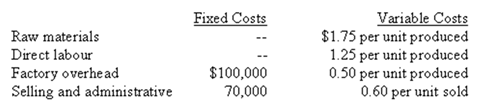

Indiana Corporation produces a single product that it sells for $9 per unit.During the first year of operations,100,000 units were produced and 90,000 units were sold.Manufacturing costs and selling and administrative expenses for the year were as follows:

What was Indiana Corporation's operating income for the year using variable costing?

Definitions:

Defective Product

A manufactured item that has a flaw or weakness making it unsafe or unfit for its intended use.

Negligence Case

Legal disputes that arise when an individual or entity fails to take reasonable care to avoid causing injury or loss to another person, resulting in harm.

Buyer's Family

Direct relatives or dependents of the purchaser, which might be considered in specific contexts like estate planning, insurance, or family-oriented transactions.

Contributory Negligence

A legal doctrine that reduces the amount of damages a plaintiff can recover in a negligence-based claim, based upon the degree to which the plaintiff's own negligence contributed to cause the injury.

Q8: Green Company's variable expenses are 75% of

Q23: Mongelli Family Inn is a bed and

Q38: A company with an income tax rate

Q48: The following data were taken from the

Q66: Internal failure costs result when a defective

Q69: What was the labour efficiency variance?<br>A) $1,375

Q69: The contribution margin ratio always increases when

Q72: If fixed expenses increase by $10,000 per

Q79: The overhead cost per unit of Product

Q108: What was the operating income for the