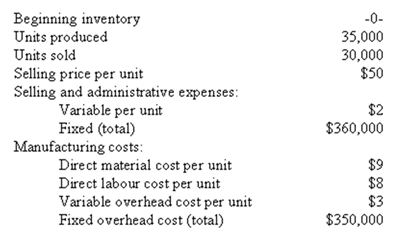

UHF Antennas,Inc.,produces and sells a unique television antenna.The company has just opened a new plant to manufacture the antenna,and the following cost and revenue data have been reported for the first month of the new plant's operation:

Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Assume that direct labour is a variable cost.

Required:

a) Assuming that the company uses absorption costing, compute the unit product cost and prepare an income statement.

b) Assuming that the company uses variable costing, compute the unit product cost and prepare an income statement.

c) Explain the reason for any difference in the ending inventories under the two costing methods and the impact of this difference on reported operating income.

Definitions:

Milestones

Key points or events in the development or progress of something, often used to mark significant stages in personal growth or project development.

ASD Diagnosis

The identification and assessment of Autism Spectrum Disorder, a developmental disorder affecting communication and behavior.

IFSP

Individualized Family Service Plan, a plan for special services for young children with developmental delays.

Cybermothers

A term that could refer to women who offer guidance or emotional support online, akin to a motherly role.

Q4: (Appendix 4A)Carson Company uses the FIFO method

Q26: The activity rate under the activity-based costing

Q45: In describing the cost formula equation Y

Q63: Eaker Company uses activity-based costing to compute

Q76: The following standards for variable manufacturing

Q92: It is generally true that if production

Q95: What was the operating income for the

Q127: The usual starting point in budgeting is

Q180: One cause of an unfavourable overhead volume

Q190: Sucher Company uses a standard cost