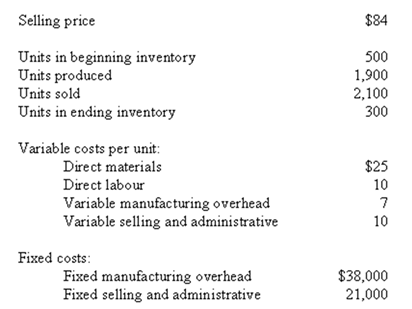

Nelson Company,which has only one product,has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a) Prepare an income statement for the month using the contribution format and the variable costing method.

b) Prepare an income statement for the month using the absorption costing method.

Definitions:

Federal Tax

Taxes levied by the national government on income, sales, property, and other activities.

Benefits Principle

A taxation principle that charges individuals based on the benefits they receive from public services.

Gasoline Tax

A levied tax on gasoline sales, often used to fund transportation projects and environmental initiatives.

Benefits Principle

A taxation principle that suggests taxes should be levied according to the benefits received by the taxpayer from governmental services.

Q31: (Appendix 4B)Assume again that the company uses

Q44: The predetermined overhead rate (i.e.,activity rate)for Activity

Q67: Because managers want stable unit cost figures,the

Q74: There are various budgets within the master

Q76: The Richmond Company uses the weighted-average method

Q76: The Tobler Company has budgeted production for

Q78: How much cost,in total,should not be allocated

Q85: What is the desired ending inventory for

Q97: Last year,Black Company reported sales of $640,000,a

Q107: (Appendix 5B)The unit product cost of product