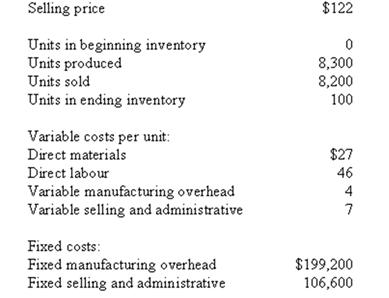

Mahugh Company,which has only one product,has provided the following data concerning its most recent month of operations:

Required:

a) What is the unit product cost for the month under variable costing?

b) What is the unit product cost for the month under absorption costing?

c) Prepare an income statement for the month using the contribution format and the variable costing method.

d) Prepare an income statement for the month using the absorption costing method.

e) Reconcile the variable costing and absorption costing operating incomes for the month.

Definitions:

Unemployment Tax

A tax paid by employers based on the total payroll and the unemployment claims filed by former employees, financing unemployment benefit programs.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Federal Form 941

A quarterly tax form used by employers to report federal withholdings from employees.

Medicare

Medicare is a federal health insurance program in the United States primarily for people who are 65 years or older, and for some younger people with disabilities.

Q2: For August,what was the variable overhead spending

Q14: For the month of April,Thorp Co.'s

Q19: Activity-based-costing (ABC)charges products for the cost of

Q60: Under variable costing,what was the company's operating

Q63: (Appendix 11A)Iraj Company retails two grades

Q72: What is the variable cost for maintenance

Q80: The overhead cost per unit of Product

Q85: What is the desired ending inventory for

Q85: How much cost,in total,would be allocated in

Q97: The cost per unit of Product A