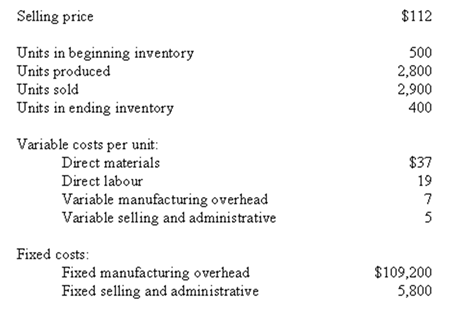

Pabbatti Company,which has only one product,has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a) What is the unit product cost for the month under variable costing?

b) Prepare an income statement for the month using the contribution format and the variable costing method.

c) Without preparing an income statement, determine the absorption costing operating income for the month. (Hint: Use the reconciliation method.)

Definitions:

Traditional Costing

An accounting method that allocates overhead costs to products based on volume-related measures, such as direct labor hours.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the actual consumption of resources.

Overhead Cost Allocated

Expenses related to the running of a business that are spread out across different departments or products.

Activity Rate

A rate used in activity-based costing to assign costs to activities based on their use of resources.

Q8: (Appendix 10A)A mix variance for direct materials

Q14: For the month of April,Thorp Co.'s

Q14: What was the amount of fixed manufacturing

Q19: Activity-based-costing (ABC)charges products for the cost of

Q27: Nelson Company,which has only one product,has provided

Q33: Budgeting aids planning and controlling the level

Q48: If the company's sales volume increases by

Q59: If the actual labour hours worked exceed

Q116: In companies that have "no lay-off" policies,the

Q120: Costs incurred at which of the following