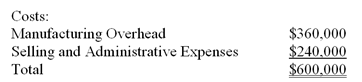

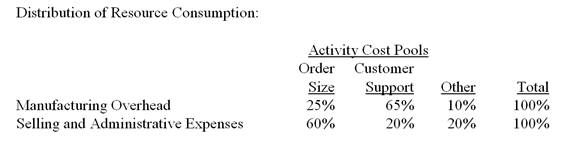

Dideda Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision making?

Definitions:

Dividend Yield

A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

Debt-to-equity Ratio

A financial ratio highlighting the use of debt versus equity in the capital structure supporting a company's assets.

Times Interest

A financial ratio indicating how many times a company can cover its interest payments with its earnings before interest and taxes.

Earnings Per Share

A financial metric that measures the profitability of a company by dividing its net income by the number of outstanding shares of its common stock.

Q5: The following cost data relate to

Q24: Business codes of ethics prescribe minimum acceptable

Q34: What is the repayment (including interest)of financing

Q41: Kelsh Company uses a predetermined overhead

Q44: The predetermined overhead rate (i.e.,activity rate)for Activity

Q50: What was the total gross margin for

Q92: It is generally true that if production

Q97: The cost per unit of Product A

Q101: The cost structure of Sackville Manufacturing Company

Q127: (Appendix 4B)Boa Corp.uses the direct method to