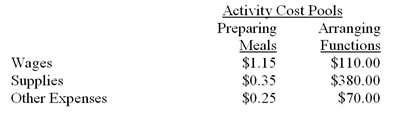

Grogam Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 100 meals were served. The company catered the function for a fixed price of $21.00 per meal. The cost of the raw ingredients for the meals was $8.25 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost, supplies and raw ingredients as a Green cost, and other expenses as a Red cost.

-(Appendix 5A) In an action analysis report prepared for the function mentioned above,what would be the "red margin" in the report,rounded to the nearest whole dollar?

Definitions:

Testosterone

A steroid hormone, predominantly found in males, responsible for the development of male secondary sexual characteristics.

Sexual Stimulation

Any stimulus (including bodily contact) that leads to, enhances, and maintains sexual arousal, and may lead to orgasm.

Ventromedial Nucleus

A region in the hypothalamus involved in regulating hunger and satiety.

Foramen Magnum

A large opening in the base of the skull through which the spinal cord passes to connect with the brain.

Q4: When a decision is made among a

Q9: Day-to-day decision making is most common to

Q17: What was the company's operating income under

Q21: For internal uses,managers are more concerned with

Q38: The balances in White Company's Work in

Q58: (Appendix 4A)Using the FIFO method,what are the

Q65: If two companies produce the same product

Q77: Which of the following should be the

Q90: Miller Company manufactures a product for which

Q108: What was the master budget operating income