Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

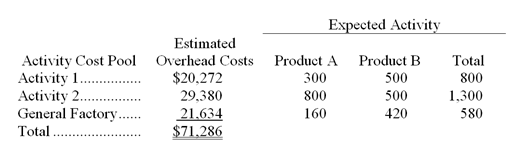

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Cognitive Development

The progression and growth of mental processes such as thinking, reasoning, and understanding through different stages of life.

Cultural Influence

The impact that culture has on the way individuals perceive, behave, and interact within society, shaping their values, norms, and practices.

Executive Functions

Executive functions are a set of cognitive processes including attentional control, inhibitory control, working memory, and cognitive flexibility, which are necessary for the cognitive control of behavior.

Cognitive Processes

The mental actions or mechanisms by which knowledge is acquired, processed, and utilized, including perception, memory, and reasoning.

Q23: (Appendix 4B)What is the value of S2

Q27: The total contribution margin decreases if sales

Q42: The contribution approach to the income statement

Q45: How many units would the company have

Q61: The Hardy Company manufactures a product that

Q63: Operating data for Fowler Company and its

Q66: What was the unit product cost for

Q81: The following information was provided by

Q85: Brabec Corporation uses direct labor-hours in its

Q86: What is the best estimate of the