Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

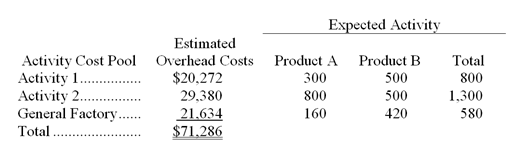

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The overhead cost per unit of Product B under the traditional costing system is closest to:

Definitions:

Inventory Cost

The total cost associated with obtaining, storing, and managing inventory, including purchase costs, storage costs, and any other expenses related to maintaining or handling inventory.

Leased Lathe

A contract arrangement where a lathe, a machine tool used for shaping metal or wood, is rented for use over a specific time period.

Credit-Approved Customers

Customers who have been evaluated and approved by a company to receive goods or services before payment, based on their creditworthiness.

Straight-Line Depreciation

Straight-line depreciation is a method of allocating the cost of a tangible asset over its useful life in equal installments.

Q15: A strategy is a game plan that

Q35: What are the equivalent units of production

Q42: The beginning cash balance is not included

Q71: What would be the total overhead cost

Q76: If total units sold remain unchanged,but the

Q82: All of the following statements about soil

Q82: Modern technology is causing shifts away from

Q110: The basic cost-volume-profit model assumes no change

Q131: Which of the following is normally included

Q135: Under absorption costing,what was the unit product