Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

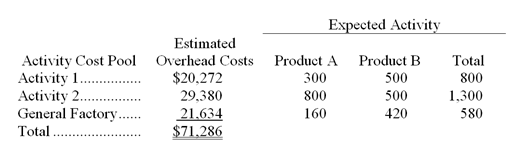

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The predetermined overhead rate (i.e.,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Defined Contribution Plans

Retirement savings plans where the amount of the retirement benefits is determined by the contributions made by the employee and/or the employer.

Retirement Income

Money an individual receives after retiring from active employment, usually in the form of pensions, savings, or investments.

Health Insurance Portability and Accountability Act (HIPAA)

U.S. legislation aimed at protecting patient health information, ensuring confidentiality, and providing data privacy and security provisions for safeguarding medical information.

Federal Insurance Contributions Act (FICA)

United States federal payroll tax legislation that funds Social Security and Medicare.

Q8: The following costs should be considered direct

Q9: What is the expected operating income next

Q16: A value chain consists of the major

Q33: What would be the total overhead cost

Q46: Qabar Company,which has only one product,has provided

Q68: In the process of biological magnification,the most

Q69: Variable costs are costs whose per unit

Q88: Knowlton Company applies overhead to completed jobs

Q103: The following journal entry would be

Q123: Carver Inc.uses the weighted-average method in its