Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

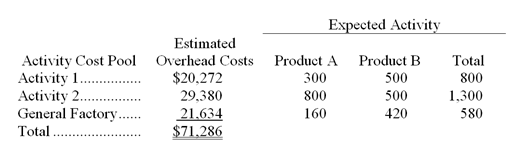

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Forward Exchange Rate

The exchange rate at which two parties agree to exchange currencies at a future date.

Forward Trade

A non-standardized contract between two parties to buy or sell an asset at a specified future date for a price that is agreed upon today.

Spot Exchange Rate

The current price for exchanging one currency for another for immediate delivery, reflecting the value of one currency in terms of another at a specific moment in time.

Forward Trade

A financial contract agreement to buy or sell assets at a specified future date and price, used primarily in commodity and currency markets.

Q1: Ogden Company uses the weighted-average method in

Q1: Which of the following is generally true

Q4: (Appendix 4A)Carson Company uses the FIFO method

Q11: The following information pertains to Rica Company:

Q26: The activity rate under the activity-based costing

Q67: What is the cost of direct materials

Q83: Mike Kyekyeku is a sole proprietorship that

Q84: Which of the following is defined as

Q94: What is the expected total administrative expense

Q123: Marling Corporation has budgeted the following data:<br><img