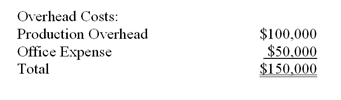

Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

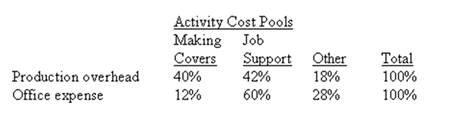

Distribution of Resource Consumption:

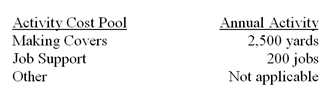

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

Required:

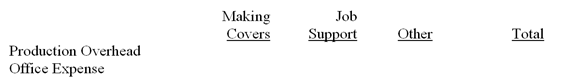

a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b) Compute the activity rates (i.e., cost per unit of activity) for the Making Covers and Job Support activity cost pools by filling in the table below:

c) (Appendix 5A) Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labour cost of $1,500. The sales revenue from this job is $2,500. For purposes of this action analysis report, direct materials and direct labour should be classified as a Green cost, production overhead as a Red cost, and office expense as a Yellow cost.

Definitions:

Involvement

The degree of participation or engagement of an individual in a particular activity, organization, or situation.

Fathers

Fathers are male parents who play a significant role in the upbringing and development of their children, contributing to their emotional, physical, and social well-being.

Mothering

The act of raising and nurturing children with love, care, and guidance, traditionally associated with female roles.

Critical Of Fathers

The tendency to analyze or judge paternal figures more harshly or meticulously, often in the context of their roles and responsibilities within the family.

Q3: (Appendix 4B)The direct method has the disadvantage

Q7: When computing the cost per equivalent unit,it

Q17: (Appendix 5B)Why would an activity-based costing system

Q23: Huish Awnings makes custom awnings for homes

Q25: The break-even in sales dollars for the

Q31: The EG Company produces and sells one

Q57: If the expected monthly sales in units

Q79: What is the best estimate of the

Q84: Indirect costs,such as manufacturing overhead,are always fixed

Q102: How is the margin of safety percentage