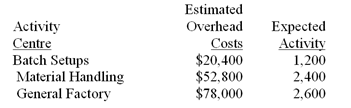

Eaker Company uses activity-based costing to compute product costs for external reports.The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool.Estimated costs and activities for the current year are presented below for the three activity centres:

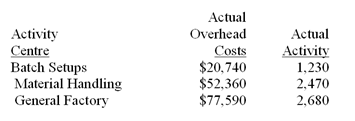

Actual costs and activities for the current year were as follows:

Required:

a) How much total overhead was applied to products during the year?

b) By how much was overhead overapplied or underapplied? (Be sure to clearly label your answer as to whether the overhead was overapplied or underapplied for each activity centre as well as for the total.)

Definitions:

Allowance for Doubtful Accounts

A contra account that reduces the total receivables on the balance sheet to reflect the amount that is expected not to be collected.

Selling Receivables

The process of selling a company's outstanding invoices to a third party to improve cash flow and reduce risk.

Risk

The possibility of experiencing loss or other adverse effects in business or investment.

Allowance Method

An accounting technique to estimate and record bad debts by recognizing a provision for accounts receivable that might not be collected.

Q2: The lean thinking model is a five

Q4: The largest volumes of transboundary shipments of

Q18: Koby Co.has sales of $200,000 with variable

Q34: (Appendix 4A)Oxyrom Company uses the FIFO method

Q54: Y Company reported operating income for Year

Q65: Kanuck Company applies overhead to completed jobs

Q71: Oakes Company,which has only one product,has provided

Q75: All of the following statements about the

Q82: All of the following statements about soil

Q87: What are discretionary fixed costs?<br>A) They vary