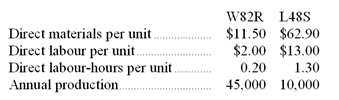

(Appendix 5B)Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,W82R and L48S,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labour-hours for the year is 22,000.

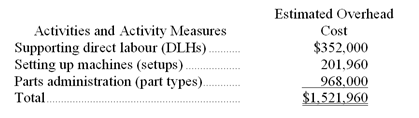

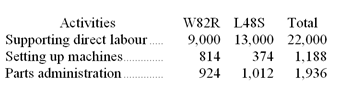

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

a. Determine the unit product cost of each of the company's two products under the traditional costing system.

b. Determine the unit product cost of each of the company's two products under activity-based costing system.

Definitions:

Warranty Repairs

Services offered to repair or replace products free of charge that have been sold with a guarantee promising repair if necessary within a certain period.

Income Statement

A financial document summarizing a company's revenues, expenses, and profits over a specific period, typically a quarter or year.

Sales Units

The number of units of a product that have been sold during a specific period.

Product Warranty Expense

Costs associated with repairing or replacing products under warranty, recognized by a company as an expense.

Q6: A cost formula may not be valid

Q6: Which of the following is NOT one

Q27: The predetermined overhead rate under the traditional

Q48: During the month of May,Bennett Manufacturing Company

Q59: Eve Company uses the weighted-average method in

Q64: What was the operating income (loss)for the

Q94: Under absorption costing,what operating income (loss)did the

Q94: Carver Test Systems manufactures automated testing

Q116: The degree of operating leverage for July

Q157: What was the cost of the units