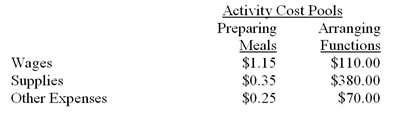

Grogam Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 100 meals were served. The company catered the function for a fixed price of $21.00 per meal. The cost of the raw ingredients for the meals was $8.25 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost, supplies and raw ingredients as a Green cost, and other expenses as a Red cost.

-(Appendix 5A) In an action analysis report prepared for the function mentioned above,what would be the "red margin" in the report,rounded to the nearest whole dollar?

Definitions:

Random Error

An error in measurement caused by unpredictable fluctuations in the variables being measured.

Least Squares Regression Line

A straight line that best fits the data points in a scatter plot by minimizing the sum of the squares of the vertical distances (residues) of the points from the line.

Relationship Between X And Y

A term often used in statistics and research to describe how two variables change relative to each other.

Vertical Spread

A trading strategy using options that involves buying and selling options of the same underlying security, same expiration date, but different strike prices.

Q5: Samantha Galloway is a managerial accountant in

Q28: (Appendix 5B)The unit product cost of product

Q46: The following journal entry would be made

Q47: Sharp Company's records show that overhead was

Q52: X Company reported the following actual

Q64: A mixed cost is partially variable and

Q86: P. Harrison Limited manufactures and sells highly

Q94: What is the expected total administrative expense

Q95: (Appendix 4A)Qart Company uses the FIFO method

Q157: What was the cost of the units