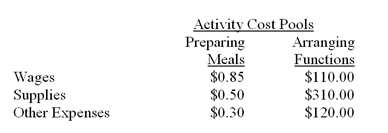

Grodt Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 60 meals were served. The company catered the function for a fixed price of $19.00 per meal. The cost of the raw ingredients for the meals was $8.60 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost, supplies and raw ingredients as a Green cost, and other expenses as a Red cost.

-(Appendix 5A) In an action analysis report prepared for the function mentioned above,what would be the "yellow margin" in the report,rounded to the nearest whole dollar?

Definitions:

Price Level

The economy-wide average price for the entirety of goods and services produced.

Profit Per Unit

The amount of net income earned by selling one unit of a product, calculated as the sales price minus the cost of production per unit.

Aggregate Supply Curve

A graphical representation that shows the total quantity of goods and services that producers in an economy are willing and able to supply at different price levels.

Price Level

A measure of the average prices of goods and services in an economy, indicating the cost of living and inflation rates.

Q3: Which entry records the purchase of raw

Q11: How would the wages of factory maintenance

Q28: A company has provided the following data:<br><img

Q79: (Appendix 4B)Assume that the company uses the

Q82: The following is last month's contribution format

Q100: (Appendix 4B)Flinders Company has two Service Departments-Factory

Q101: Fabian Company uses the weighted-average method in

Q113: (Appendix 4B)Total costs in the Personnel Department

Q114: What is the total contribution margin for

Q139: Assuming that Cherrington Company uses the weighted-average