Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

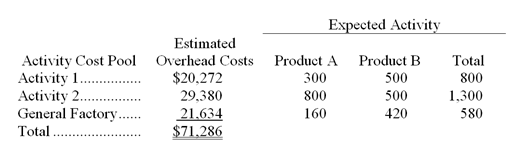

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The predetermined overhead rate (i.e.,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Monthly Financial Advantage

This term does not correspond to a widely recognized financial concept. However, it could refer to the monthly surplus or savings that a business or individual achieves after covering all their expenses.

Outside Supplier

A third-party entity or company that provides goods or services to another company, typically not affiliated with the purchasing company's internal structure.

Grinding Machines

Mechanical equipment designed for the surface finishing of workpieces by removing material through abrasion, often used in manufacturing and metalworking.

Least Profitable

Refers to the product, service, or segment generating the lowest amount of profit compared to others.

Q3: The Central Valley Company is a merchandising

Q13: Which of the following groups should be

Q23: (Appendix 4B)What is the value of S2

Q35: Persons occupying staff positions provide support and

Q72: If fixed expenses increase by $10,000 per

Q86: Flyer Corporation manufactures two products,Product A and

Q96: The following data pertain to activity and

Q116: What was the operating income for the

Q130: Which of the following statements is true

Q157: What was the cost of the units