Addison Company has two products: A and B. Annual production and sales are 800 units of Product A and 700 units of Product B. The company has traditionally used direct labour-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.2 direct labour hours per unit and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $71,286.

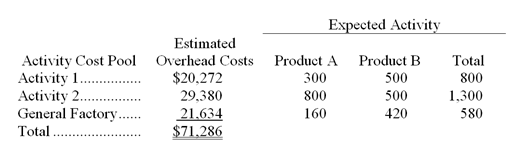

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B) The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Free-Living

Describes organisms that do not depend on another organism for survival; they are not parasitic and can exist independently in an environment.

Aquatic

Pertaining to water; living or occurring in water, whether it be freshwater, brackish, or saltwater.

Parasitic

Pertaining to an organism that lives on or in a host organism and causes harm to the host.

Terrestrial

Pertaining to or representing the earth or dry land, as opposed to aquatic environments.

Q1: Which of the following statements about overhead

Q38: What was the cost of goods manufactured

Q44: All three major professional accounting groups in

Q56: The construction of dams,canals,and reservoirs<br>A)does not affect

Q66: Within the relevant range of activity,how will

Q92: Using the high-low method,the estimated variable cost

Q96: What is the degree of operating leverage?<br>A)

Q100: The following information pertains to Malcolm Corporation

Q101: The break-even point in unit sales increases

Q127: Although variable costing is NOT permitted for