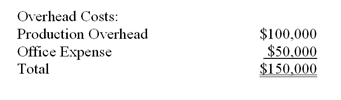

Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

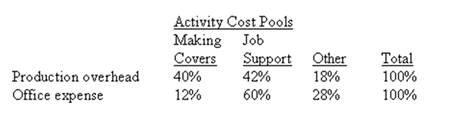

Distribution of Resource Consumption:

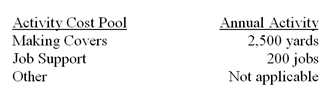

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

Required:

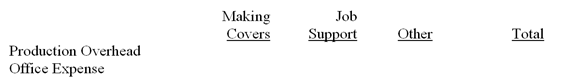

a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b) Compute the activity rates (i.e., cost per unit of activity) for the Making Covers and Job Support activity cost pools by filling in the table below:

c) (Appendix 5A) Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labour cost of $1,500. The sales revenue from this job is $2,500. For purposes of this action analysis report, direct materials and direct labour should be classified as a Green cost, production overhead as a Red cost, and office expense as a Yellow cost.

Definitions:

Duchenne Smile

A genuine smile that involves contraction of both the zygomatic major muscle (raising the corners of the mouth) and the orbicularis oculi muscle (raising the cheeks and forming crow's feet around the eyes).

Genuine Smile

A true expression of happiness or pleasure characterized by the movement of the muscles around the eyes and mouth.

Venting Anger

The act of expressing or releasing anger, often in the hope of achieving relief or catharsis, though its effectiveness can vary.

Catharsis

A psychological concept suggesting that expressing or experiencing strong emotions can lead to a sense of emotional release or purification.

Q1: What was the March 1 balance in

Q4: When a decision is made among a

Q18: To the nearest whole dollar,how much wages

Q48: The labour time ticket contains a detailed

Q68: Lucy Sportswear manufactures a specialty line

Q83: The Hadfield Company manufactures and sells a

Q88: Knowlton Company applies overhead to completed jobs

Q91: Sales = Variable expenses + Fixed expenses

Q93: The Collins Company uses a job-order

Q101: The cost structure of Sackville Manufacturing Company