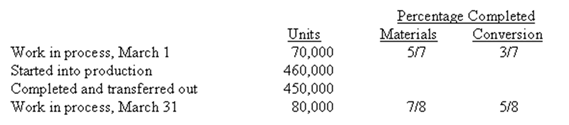

(Appendix 4A)The Smith Company manufactures a product that goes through two departments prior to completion.The following information is available on work in one of these departments,the Forming Department,during March:

Cost in the beginning work-in-process inventory and cost added during the month were as follows:

The Forming Department is the first department in the production process; after forming has been completed, the units are transferred to the Finishing Department.

Required:

a) Assuming the company uses the weighted-average method, calculate the equivalent units and unit cost for materials and conversion costs, rounded to the nearest tenth of a cent.

b) (Appendix 4A) Assuming the company uses the FIFO method, calculate the equivalent units and unit cost for materials and conversion costs, rounded to the nearest tenth of a cent.

Definitions:

Natural Search Results

Listings on search engine results pages that appear because of their relevance to the search terms, as opposed to being advertisements.

Truth-In-Lending Act

U.S. federal law designed to promote informed use of consumer credit, by requiring disclosures about its terms and cost.

Disclosure Requirements

Regulations mandating that certain information be made available to the public or specific entities, often to ensure transparency and accountability.

FCC's Open Internet Rules

Regulations established by the Federal Communications Commission to ensure net neutrality, prohibiting internet service providers from discriminating against content or users.

Q15: Although suburbanization has resulted in residential dispersion,the

Q16: If the fixed expenses increase in a

Q34: How much cost,in total,would be allocated in

Q39: The region that contains about 60% of

Q39: The gentrification process is predicted by the

Q52: The following inventory valuation errors were

Q64: Air pollution<br>A)is caused primarily by burning fossil

Q76: The Richmond Company uses the weighted-average method

Q84: Indirect costs,such as manufacturing overhead,are always fixed

Q105: Carver Company produces a product that sells