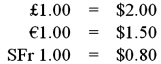

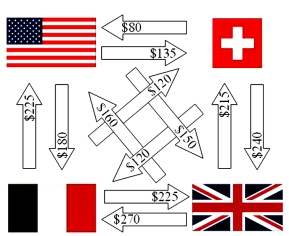

Simplify the following set of intra company cash flows for this Swiss Firm. Use the following exchange rates.  The fewest number of intra-affiliate cash flows is

The fewest number of intra-affiliate cash flows is

Definitions:

Asset Allocation Funds

Mutual funds that invest in a variety of asset classes, such as stocks, bonds, and real estate, to diversify investment risk.

Event-driven Funds

Investment funds that seek to exploit pricing inefficiencies that may occur before or after a particular corporate event.

Market-neutral Hedge Funds

Market-neutral hedge funds aim to achieve returns with minimal exposure to overall market risk by employing strategies that attempt to offset potential losses in the markets.

Volatile Returns

Refers to the significant ups and downs in the value of an investment over a short period.

Q33: Trade barriers can arise naturally. Which of

Q48: Calculate the euro-based return an Italian investor

Q55: Determine the amount the exporter will receive

Q63: Compute the debt-to-total-value ratio for a firm

Q68: The adjusted present value (APV) model that

Q73: In reference to establishing "transfer prices" between

Q74: Calculate the euro-based return an Italian investor

Q85: Some of the risks that a U.S.

Q86: Mislocated funds are defined as:<br>A)Funds being found

Q95: Determine the bond equivalent yield the importer's