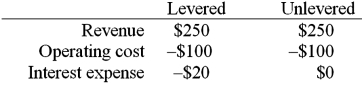

Given the following information for a levered and unlevered firm, calculate the difference in the cash flow available to investors. Assume the corporate tax rate is 40%. (Hint: Calculate the tax savings arising form the tax deductibility of interest payments) .

Definitions:

Benchmark

A standard or point of reference against which the performance of a security, mutual fund, or investment manager can be measured.

Management Fee

A charge paid to a company's managers for their services, often a percentage of managed assets or profits.

Net Return

The profit or loss from an investment after all expenses, including taxes, fees, and costs, have been subtracted.

Market Neutral

An investment strategy aiming to achieve returns independent of the overall market direction by simultaneously buying assets expected to rise and shorting assets expected to fall.

Q4: Table 22-4 presents the demand and supply

Q11: Such products as mineral ore and cement

Q18: Determine the amount the exporter will receive

Q35: The spot exchange rate is ¥125 =

Q66: An all-or-none order is a limit order

Q70: Precautionary cash balances<br>A)are necessary in case the

Q71: A measure of liquidity for a stock

Q78: According to the internalization theory of FDI<br>A)firms

Q94: Assume that XYZ Corporation is a leveraged

Q97: Consider a fixed for fixed currency swap.