Solve for the weighted average cost of capital:

Definitions:

Option Price

The price at which a specific derivative contract can be exercised, representing the cost to buy (call option) or sell (put option) an underlying asset at the strike price.

Riskless Arbitrage

An investment strategy that involves exploiting price differences of identical or similar financial instruments on different markets or in different forms.

Standard Deviation

A statistical measure that quantifies the amount of variation or dispersion of a set of data values from the mean.

Theoretical Value

The estimated price of an asset or financial instrument based on mathematical models instead of market prices, often used in options pricing.

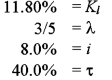

Q23: Using the weighted average cost of capital

Q37: In the notation of the book, K

Q42: Micro Spinoffs, Inc., issued 20-year debt one

Q47: Imperfections in the market for intangible assets

Q54: A "specialist"<br>A)makes a market by holding an

Q59: As a rule, payments to and from

Q59: "Unbundling fund transfers" from an MNC and

Q68: A withholding tax is defined by your

Q75: The dominant source of FDI outflows<br>A)several developed

Q81: The stock market of country A has