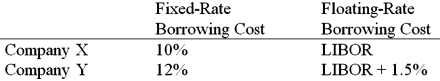

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of rate of 9.90%.in exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of rate of 9.90%.in exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

Definitions:

Exclusive Contracts

Agreements that restrict individuals or entities to engage or transact with only one party, commonly seen in professional sports and the entertainment industry.

Adhesion Contract

A standard-form contract prepared by one party, with little or no negotiation with the weaker party, often in situations where the choices or bargaining power is limited.

Vaudeville Star

A performer who was popular on the vaudeville circuit, a series of variety entertainment shows in the late 19th and early 20th centuries.

The Jazz Singer

The first feature-length motion picture with synchronized dialogue sequences, marking a pivotal moment in the transition from silent to sound films.

Q8: Estimate the value of the option on

Q11: The underwriting syndicate of a bond offering

Q19: Suppose a U.S.-based MNC maintains a vacation

Q21: Stock in Daimler AG, the famous German

Q39: American Depository Receipt (ADRs) represent foreign stocks<br>A)denominated

Q57: A bank may establish a multinational operation

Q58: With regard to the past price performance

Q59: Translation exposure refers to<br>A)accounting exposure.<br>B)the effect that

Q77: In 2002, 24 stock markets had concentration

Q80: In any given year, about what percent