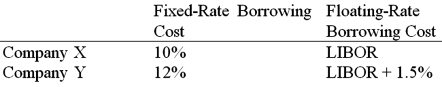

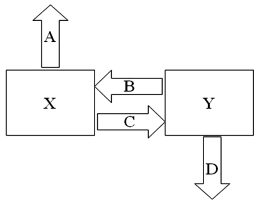

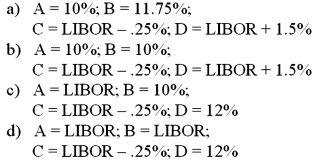

Company X wants to borrow $10,000,000 floating for 5 years. Company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

Definitions:

Subunit Activities

Activities or tasks performed by individual parts of an organization, contributing to the overall operational goals.

Volume-Based Cost Driver

A measure that allocates costs based on the volume of goods produced or services rendered, such as units produced or hours worked.

Factory Floor Area

The physical space within a manufacturing facility where goods are produced or processed.

Traditional Costing System

An accounting method that allocates manufacturing overhead based on the volume of products produced, often using a single predetermined overhead rate.

Q7: Solve for the weighted average cost of

Q33: What is the NPV of the project

Q47: Suppose that the British stock market is

Q51: On the basis of regression Equation <img

Q56: Foreign banks that establish subsidiary and affiliate

Q64: The smaller the concentration percentage,<br>A)the more concentrated

Q92: Assume that the firm will partially finance

Q95: Calculate the euro-based return an Italian investor

Q95: Multinational cash management<br>A)is really no different for

Q98: Find the debt-to-value ratio for a firm