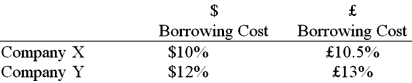

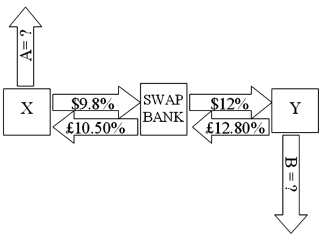

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are:  A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap, what external actions should they engage in?

If company X takes on the swap, what external actions should they engage in?

Definitions:

Disease

A particular abnormal condition that negatively affects the structure or function of part or all of an organism, and that is not due to any immediate external injury.

Delusion Of Persecution

A false belief where a person thinks that others are intentionally trying to harm them.

Poison

A substance that is capable of causing illness or death when introduced into or absorbed by a living organism.

REM Sleep

A phase of sleep characterized by rapid eye movements and a high level of brain activity, often associated with vivid dreaming.

Q18: Who benefits from debt-for-equity swaps?<br>A)The creditor bank<br>B)The

Q21: Stock in Daimler AG, the famous German

Q42: Find the net cash flow in (out

Q51: In what year were U.S. MNCs mandated

Q55: With regard to the financial structure of

Q56: Fill out the 20 missing entries that

Q65: The required return on equity for an

Q74: As of today, the spot exchange rate

Q94: Fill out the following figure with the

Q99: When using the APV methodology, what is