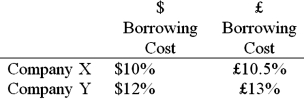

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk

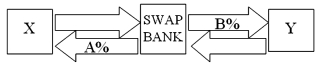

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

First Impression

The initial judgment or assessment of something or someone, formed on first encountering them, often considered to be lasting and significant.

Legal Authorities

Sources of law, such as statutes, cases, or regulations, that have the power to bind or guide legal proceedings.

Government Policy

A course of action or a set of decisions adopted by a government or a political entity to influence or guide a wide range of activities and behaviors.

Equitable Remedy

A form of legal relief sought in a lawsuit that requires a party to act or refrain from acting, rather than merely paying damages.

Q10: Recent studies suggest that agency costs of

Q24: Calculate the euro-based return an Italian investor

Q49: Cross-border acquisitions of businesses are a politically

Q53: You entered in to a 3 ×

Q62: In a currency swap<br>A)it may be the

Q69: Company X wants to borrow $10,000,000 floating

Q81: While there is no comprehensive theory of

Q84: Explain how firm B could use the

Q90: The mean and standard deviation (SD) of

Q93: As of today, the spot exchange rate