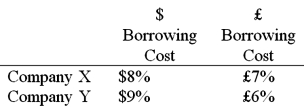

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year. The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00 × (1.08) /£1.00 × (1.06) = $2.0377/£1. Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Indorsement

The act of signing one's name on the back of a check, bill of exchange, or similar document, transferring the rights to another party.

Maker

The person or entity that creates or produces something, often referred to in contexts such as art, manufacturing, or finance.

Notes

Short-term financial instruments, typically in the form of a debt or loan, that require repayment of the principal and interest by the issuer.

Drafts

Preliminary versions of documents, or negotiable instruments drawn by one party (drawer) ordering another party (drawee) to pay a specified sum to a third party.

Q3: Consider the balance sheets of Bank A

Q16: With regard to clearing procedures for bond

Q19: In the early 1980s, Honda, the Japanese

Q19: Suppose a U.S.-based MNC maintains a vacation

Q22: A bank bought a "three against six"

Q25: As a mode of entry into a

Q49: The firm's tax rate is 34%. The

Q69: Under the current/noncurrent method<br>A)a foreign subsidiary with

Q70: Price discovery in the secondary stock markets<br>A)occurs

Q82: When an interest-only swap is established on