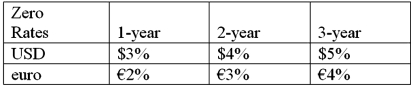

Suppose that you are a swap bank and you notice that interest rates on zero coupon bonds are as shown. Develop the 3-year bid price of a dollar swap quoted against flat USD LIBOR.  In other words, what you be willing to pay in euro against receiving USD LIBOR?

In other words, what you be willing to pay in euro against receiving USD LIBOR?

Definitions:

Operating and Financial Affairs

The various activities related to managing a company's day-to-day operations and handling its financial resources.

Investee

A company or entity in which an investor holds a minority ownership stake or interest, but not controlling interest.

Common Stock

A form of corporate equity ownership, a type of security representing an ownership stake in a company, with voting rights and potential for dividends.

Short-Term Investment

Financial assets that are expected to be converted into cash or sold within one year or within the current business cycle.

Q15: There are two types of equity related

Q32: A market order<br>A)is an instruction from a

Q58: ADRs<br>A)are American Depository Receipts.<br>B)denominated in U.S. dollars

Q63: For those investors who desire international equity

Q72: Act as a swap bank and quote

Q80: Which of the following would be an

Q83: Operating exposure can be defined as<br>A)the link

Q87: A "three against nine" forward rate agreement<br>A)could

Q87: Advantages of investing in U.S.-based international mutual

Q91: In the wholesale money market, denominations<br>A)are at