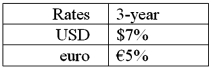

Suppose that you are a swap bank and you notice that interest rates on coupon bonds are as shown. Develop the 3-year bid price of a euro swap quoted against flat USD LIBOR. The current spot exchange rate is $1.50 per €1.00. The size of the swap is €40 million versus $60 million.  In other words, what you be willing to pay in euro against receiving USD LIBOR?

In other words, what you be willing to pay in euro against receiving USD LIBOR?

Definitions:

Teratogenic

Pertaining to or capable of causing birth defects or developmental abnormalities in an embryo or fetus.

Caffeine

A stimulant found in coffee, tea, and other beverages, known to enhance alertness and energy levels.

Coffee

A brewed drink prepared from roasted coffee beans, which are the seeds of berries from the Coffea plant.

Moderate Drinking

Consuming alcohol in a manner that is within recommended guidelines and limits, minimizing health risks.

Q18: Which type of trading system is desirable

Q36: Decompose the return an American would have

Q72: When using the APV methodology, what is

Q73: Investors will generally accept a lower yield

Q75: The link between the home currency value

Q81: The OTC market<br>A)does not accept credit-the dealers

Q88: Assume that the risk-free rate of return

Q88: Unlike day orders, a good-til-cancelled (GTC) order

Q89: A common set of factors that affect

Q99: Macroeconomic factors affecting international equity returns include<br>A)exchange