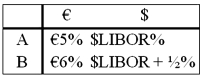

Come up with a swap (exchange of interest and principal) for parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

Definitions:

GICs

Guaranteed Investment Certificates, a type of Canadian investment that offers a guaranteed rate of return over a fixed period of time.

Compounded Annually

Interest on an investment calculated once a year, taking into account both the initial principal and the interest from previous periods.

Maturity Value

The amount payable to an investor at the end of a bond's term or at the time of maturity, including both the principal and interest.

Income Yield

A financial ratio that shows how much a company pays out in dividends each year relative to its stock price.

Q10: A swap bank<br>A)can act as a broker,

Q11: The underwriting syndicate of a bond offering

Q25: The "functional currency" is defined in FASB

Q32: Find the NPV in dollars for the

Q48: Consider the borrowing rates for Parties A

Q49: You are the debt manager for a

Q69: Using your results to the last question,

Q81: Using the APV method, what is the

Q82: In contrast to many domestic bonds, which

Q83: On the Paris bourse, shares of Avionelle