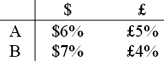

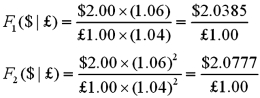

Consider the situation of firm A and firmB. The current exchange rate is $2.00/£ Firm A is a U.S. MNC and wants to borrow £30 million for 2 years. Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings.  The IRP 1-year and 2-year forward exchange rates are

The IRP 1-year and 2-year forward exchange rates are

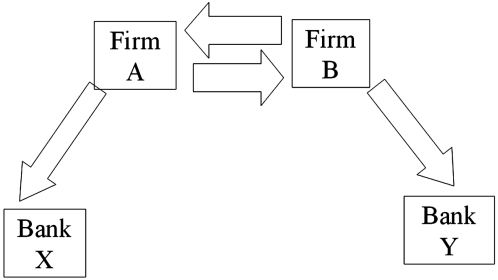

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Definitions:

Additional Time

An extension of time provided beyond the original allotment, often used in contexts such as examinations, project deadlines, or sports matches.

Inches

A unit of length in the imperial and United States customary systems, equivalent to 1/12 of a foot or 25.4 millimeters.

Contemporary Perspective

Present-day viewpoints or methods of understanding in a particular field, often considering the latest research and developments.

Daily Basis

The frequency of something happening or being performed every day.

Q4: Solve for the weighted average cost of

Q5: Which combination of the following statements is

Q14: Assume that XYZ Corporation is a leveraged

Q16: Which of the following are principles of

Q19: Suppose a U.S.-based MNC maintains a vacation

Q38: Generally speaking, a firm is subject to

Q43: The source of translation exposure<br>A)is a mismatch

Q63: Many lessons should be learned from the

Q68: The common stock of Kansas City Power

Q87: Consider a plain vanilla interest rate swap.