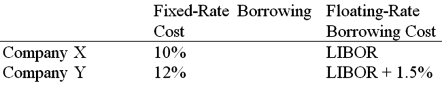

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat.

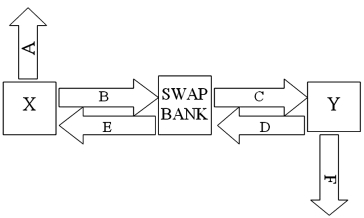

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat.  Assume both X and Y agree to the swap bank's terms. Fill in the values for A, B, C, D, E, & F on the diagram.

Assume both X and Y agree to the swap bank's terms. Fill in the values for A, B, C, D, E, & F on the diagram.

Definitions:

Q3: Find the price of a 30-year zero

Q8: Consider a U.S.-based MNC with manufacturing activities

Q16: Which of the following are principles of

Q20: The hedge fund manager notices the optionality

Q22: Private placement bond issues<br>A)do not have to

Q25: The stock market of country A has

Q32: If French-based Affiliate A owes U.S.-based affiliate

Q41: Find the weighted average cost of capital

Q43: Find the break-even price (in dollars) and

Q98: MNCs might have been lured to invest