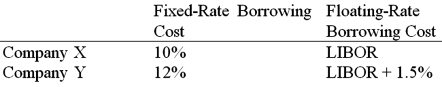

Company X wants to borrow $10,000,000 floating for 5 years. Company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

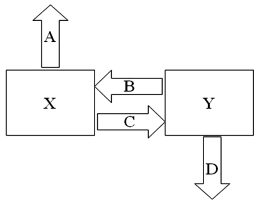

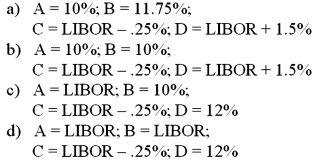

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

Definitions:

Taxable Income

The portion of an individual's or organization's income that is subject to taxation by governing authorities.

Horizontal Equity

Horizontal equity is a principle in taxation that dictates that individuals with similar income and assets should pay the same amount in taxes.

Vertical Equity

A principle in taxation that individuals with a higher ability to pay should contribute more taxes.

Progressivity

Refers to a tax system in which the tax rate increases as the taxable amount increases.

Q1: Calculate the euro-based return an Italian investor

Q11: Approximately _ of wholesale Eurobank external liabilities

Q22: Following Honda's FDI in the U.S.,<br>A)the U.S.

Q32: In the notation of the book, K

Q37: Suppose the quote for a five-year swap

Q45: iShares MSCI are<br>A)exchange traded funds that are

Q51: In what year were U.S. MNCs mandated

Q57: A bank may establish a multinational operation

Q75: The link between the home currency value

Q96: Countries may welcome greenfield investments,<br>A)as they are