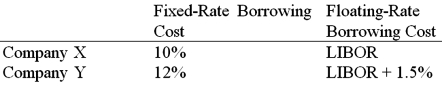

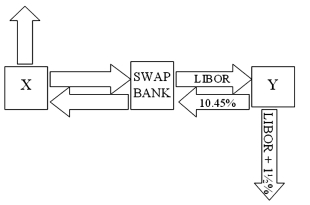

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume company Y has agreed, but company X will only agree to the swap if the bank offers better terms.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume company Y has agreed, but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X, given that it already booked Y?

Definitions:

Tax Burden

The measure of the total amount of taxes that individuals, businesses, or other entities must pay, relative to their income or profits.

Tax Revenues

The income that is gained by governments through taxation, which is used to fund public services, government obligations, and goods.

Benefits Principle

A concept that suggests taxes should be levied based on the benefits received by taxpayers, ensuring that those who benefit more from public services pay more taxes.

Ability-To-Pay Principle

The ability-to-pay principle is a tax theory suggesting that taxes should be levied based on the taxpayer’s capacity to pay, implying that wealthier individuals should pay more in taxes.

Q17: Reasons for a country to impose exchange

Q22: The advantages of a market order include

Q31: Not all countries allow MNCs the freedom

Q42: Micro Spinoffs, Inc., issued 20-year debt one

Q56: The U.S. IRS allows transfer prices to

Q59: Some of the factors (with selected explanations)

Q60: When the Mexican peso collapsed in 1994,

Q72: Country risk refers to<br>A)political risk.<br>B)credit risk, and

Q80: The cost of equity capital is<br>A)the expected

Q100: The cost of capital is<br>A)the minimum rate