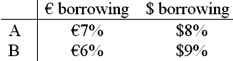

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00, a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR:  The firms external borrowing opportunities are:

The firms external borrowing opportunities are:

Definitions:

Accounts Receivable Turnover

Accounts receivable turnover is a financial ratio that measures how effectively a company is collecting on its credit sales by comparing net credit sales with the average accounts receivable for a period.

Financial Statement Analysis

Financial statement analysis involves evaluating the financial statements of a company to assess its performance and make informed business decisions.

IRS Audit

A formal examination by the Internal Revenue Service to verify the accuracy of a taxpayer's returns and financial records.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets.

Q1: Studies examining the influence of industrial structure

Q8: Fill out the following figure with the

Q11: Find the NPV in euro for the

Q20: An increase in political risk can be

Q31: The parent company should decide the financing

Q39: Translation exposure measures<br>A)the effect that an anticipated

Q49: The sale of previously issued common stock

Q82: Proceeding the Asian crisis,<br>A)domestic price bubbles in

Q85: Exchange rate fluctuations contribute to the risk

Q89: Eurobonds are usually<br>A)bearer bonds.<br>B)registered bonds.<br>C)bulldog bonds.<br>D)foreign currency